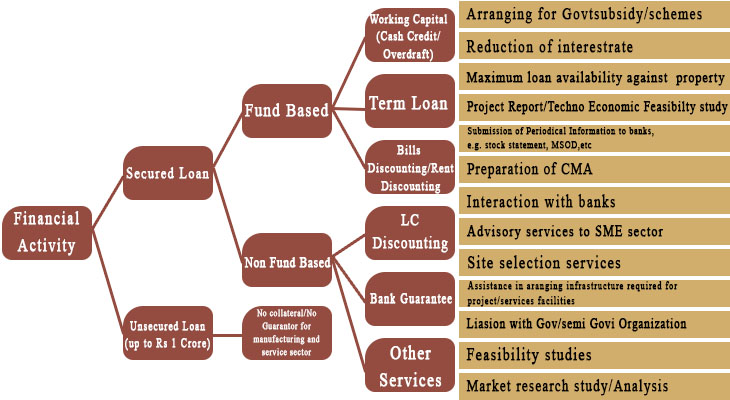

Bank Support Services

MiDi is financial service provider explicitly committed to improving access to finance for sustainable MSMEs. The effective management of lending to SMEs can contribute significantly to the overall growth and profitability of banks.

There has been considerable research and analysis into the methods by which banks assess and monitor business loans, manage business financing risks and price their products – and how these methods might be further developed and improved.

There has been particularly intensive security of the kinds of business financial information that banks use in making lending decisions and how that information is reliable.

Banks have traditionally relied on a combination of documentary sources of information, interviews and visits, and the personal knowledge and expertise of managers in assessing and monitoring business loans.

However, when assessing comparatively small and straightforward business credit applications, banks may largely rely on standardized credit scoring techniques (quantifying such things as the characteristics, assets, and cash flows of businesses/owners).

Using such techniques – and also centralizing or rationalizing business-banking operations generally- can significantly reduce processing costs.We, at MiDi, are in a position to make this whole business lending process as simple as possible.

1

1 2

2